Set a Savings Target

A savings target is a great way to save for the things that you want, whether that be a new car, a holiday away or even a deposit for a home.

Active saving has found to be a contributing factor in financial wellbeing. Saving is not only good for you, it’s a great way to achieve your life goals.

It shouldn’t be too easy to access your savings – otherwise you’ll be tempted to spend it on things other than your goal.

When creating a savings target, pick an account designed for saving or investments e.g. Sharesies, Dedicated Savings Account or a Simplicity Fund.

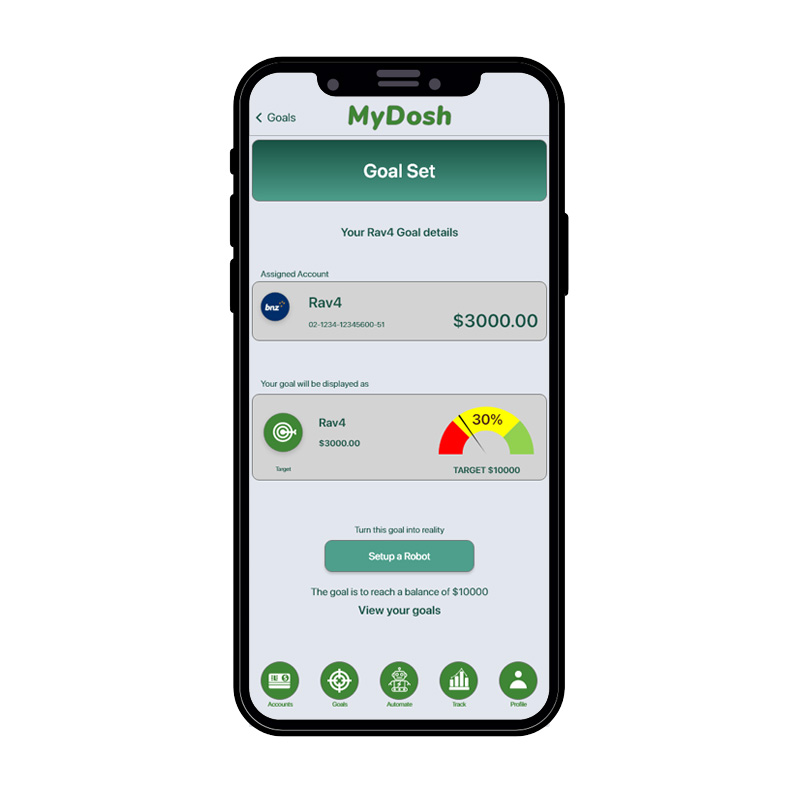

MyDosh will display your progress – the needle and percentage show your progress toward the target amount.

Tip: You could create a robot to put any excess from your emergency fund into your savings account.

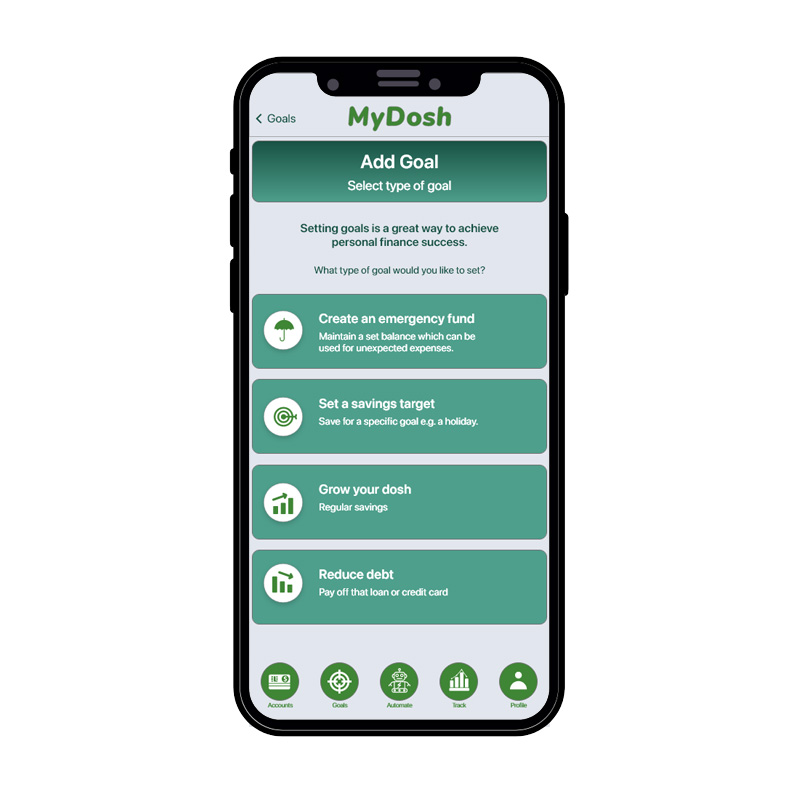

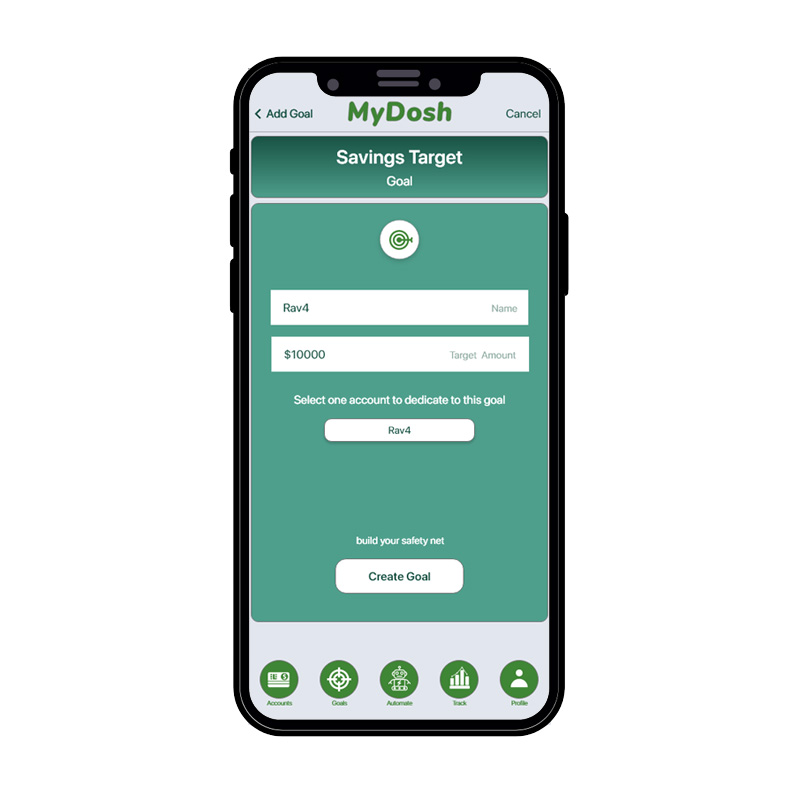

How to use this feature

- Step 1:

- Select add goal

- Step 2:

- Set a target amount

- Step 3:

- Designate an account

- Step 4:

- Confirm goal

- Step 5:

- Create a robot automation